Inflation, Deflation, or Hyper-inflation?

June 27, 2010 Leave a comment

Well it seems that the $787 billion stimulus package and the countless trillions doled out by the Fed designed to get our economy back on track is starting to stall out. Conventional economic theory says that when private sector demand falls off a cliff, it’s the governments job to step in and boost demand. This has worked in the past i.e. (recession of 2001), this depression however is different. The recession of 2001 was an equity recession so pumping money into the economy worked to boost stock prices, one unintended consequence was that it also spurred a lending boom that flowed into housing. This is the central difference between this recession and the last one, 2001 was an equity recession 2008 to present is a debt recession. This is also the problem with conventional economic theory. All the textbooks tell Bernanke to print, print, print to rescue us from the perils of deflation which would work in an equity recession but not in a debt recession and especially not one of this size. By the banking industry’s own estimates there are $5 trillion worth of bad loans sitting on their balance sheets dragging them under water. This is why banks are not lending. Unfortunately the textbook response to increase the money supply to jump start lending is backfiring

The next problem with conventional econ0mic theory is that it states that inflation requires two things 1. an increase in the money supply (check) and 2. monetary velocity (nope, look at the chart, banks aren’t lending) this is where the deflationists get their proof. This however is a misguided approach in that they don’t factor in peoples perception of the future value of money. If you truly want to measure inflation, look at a chart of gold, as gold cannot be produced from nothing so it therefore maintains it’s purchasing power.

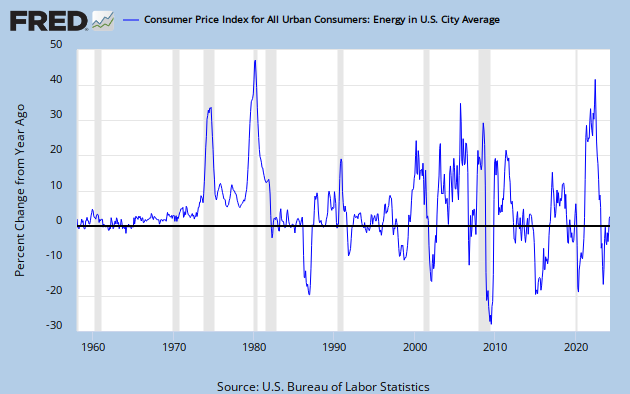

If you believe gov. statistics then inflation is an average of about 3% a year, but here’s the catch they don’t include “volatile” food and energy prices when calculating inflation. Wait a sec. thats means that if food and energy rise 30% and everything else rises 2% then inflation is only 2%. Does this make any sense? Didn’t think so. But wait how could we have inflation without banks lending? There’s that market psychology again. This is why I believe we will spiral into hyperinflation (or at the very least double-digit inflation like the 1970’s). The textbooks say that Bernanke has to hold down interest rates (print money) till unemployment comes down to an acceptable level (about 5%). The problem is that in a mean time prices will have skyrocketed by then because unemployment is at about 18% and employers aren’t hiring. If the Fed does print us into oblivion we will all end up like Zimbabwe.

Yes, you read that right, $100 BILLION for three eggs. The only thing that will stop us from this fate is the Fed stops printing yesterday. It will not be pretty, it will not be nice, but I prefer 25% unemployment to $100 billion for three eggs, don’t you?